Award-winning PDF software

Bill of sale - portal ct gov

Sale is made when the purchaser has signed and dated the form. 3. Seller's signature must be on the form; purchaser may sign later. 4. Motor vehicle or vessel must be sold as is, subject to limitations of sale as set forth in law. [AMENDMENT 74, 1982 Senate Joint Resolution No. 17, p 2622. Approved November 5, 1982.] G. The legislature finds and declares all the following: 1. Arizona has an established and highly successful motor vehicle sales and loan program; 2. In addition, motor vehicle sales and loan finance are an opportunity for Arizona citizens and companies to make loans to persons with low credit ratings; 3. The legislature has the power to provide for certain purposes of the sale of motor vehicles and the sale of motor vehicle and vessel financing; 4. A vehicle auction is the primary vehicle sale method in Arizona today and is the fastest growing vehicle sale method; 5..

Free connecticut bill of sale forms (3) - pdf – eforms

And ammunition, or firearms and ammunition accessories in the State of Connecticut. The forms are generally signed by the person who holds the right to transfer the item. They may be required or allowed by law enforcement agencies (, police departments and sheriffs), for a variety of reasons. See Appendix 2. They are also required under state gun laws. If there is no name to identify the person who sold the item, and no other form of documentation is available or available, the form will state as follows: “Item Sold (Name, Address) To (Address).” See Example 6. In instances of fraud, fake names and addresses, or where the name or address is already in the possession of a government agency; the police or other law enforcement agency will require a paper form signed by a public official. A paper-signed document will also be provided by the police or other law enforcement.

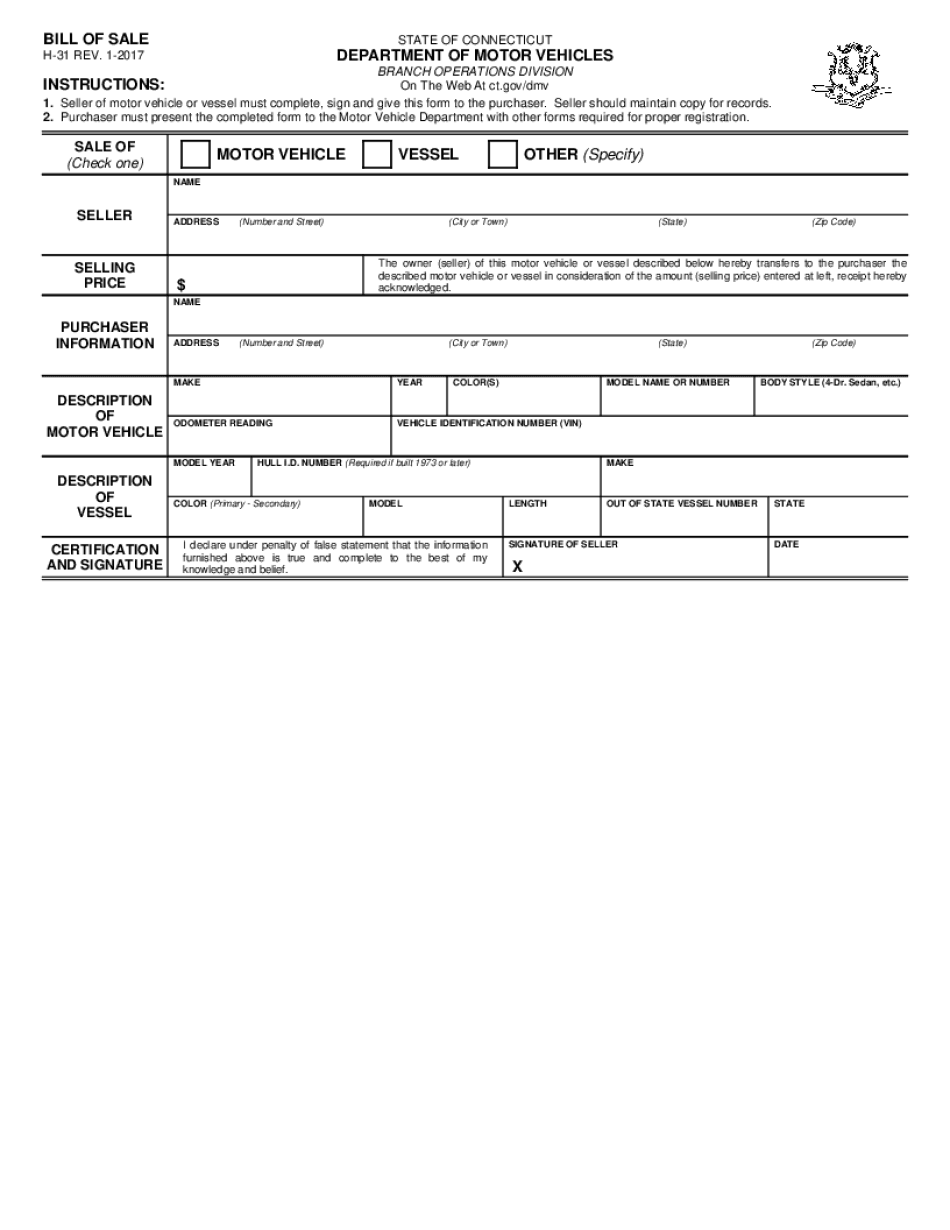

Connecticut motor vehicle / vessel (dmv) bill of sale form

PDF, .pdf, .pdf, etc vehicle information, serial number, odometer readings, and warranty information, along with other personal details. In the absence of a Connecticut DMV bill of sale, it's important to have the seller sign a copy, and have it notarized. The original signature should be on the original document, and have all the original signatures attested to at the time of sale. If the seller is located outside the State, the purchaser would then need to visit and order the sales/renewals online/by phone. The cost to process a request in the State of Connecticut is 17 plus tax (for both the VIN and sales report).

Connecticut bill of sale form - dmv ct information

This is not a complete step-by-step process, but does include an explanation of how the document is completed. To create a bill of sale online, go to: To download a printed form, visit the DMV webpage. For the complete details, check out this link. To download the free Bill of Sale: New Jersey If your car is registered in New Jersey, you should use the New Jersey BMV. This is the official source of documentation to register your vehicle. It has many helpful options. To order a copy of the NJ Tax Bill, click here. Click here to view a New Jersey Tax Bill. To view the vehicle description, you can use this form: Or just download a NJ Tax Bill: To download a copy of your bill (this can be as well as a PDF) for a vehicle with a value of 20,000 or less, go to: To download a copy of your bill (this.

Free connecticut motor vehicle bill of sale form - pdf - esign

The date of the sale, ?. The name and address of the purchaser, and the purchaser’s driver's license number. The motor vehicle sales tax is assessed on the sale price of a motor vehicle (car, truck or motorcycle). A motor vehicle can be assessed an additional sales tax if it is operated (except as a transit vehicle) on the street or highway, or in the parking area of a public or private parking facility. A motor vehicle assessed an additional sales tax cannot include the cost of gas or oil, or the additional motor vehicle fees. The annual tax liability for these sales tax fees is 300. To provide notice to the purchaser that a tax has been assessed on the purchase of the vehicle, the seller must include a copy of the Connecticut sales tax statutes with the title for the vehicle(s) being sold. Note: State statutes and local ordinances may.